Faster & More Accurate Landed Cost Analysis

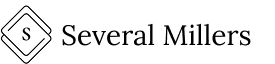

Its April of 2025, and the hottest topic in supply chain is duties & tariffs.

As companies rush to analyze the impact of the tariffs, we have been exploring how technology can help perform related analysis faster & more accurately, automating much of the workflow.

During the initial wave of tariffs in 2018, I was working as a logistics manager, and I spent many an hour on hts.usitc.gov, rulings.cbp.gov, and federalregister.gov, not to mention combing through the documents of every inbound shipment to confirm the HTS codes were correct.

Today, we are able to automate much of this work, leveraging API services and our own custom HTS code classification agent, woven together as an automated end-to-end duty rate calculation system. You can check out the demo here:

Demo video showing automated HTS code classification & duty rate calculation

The remainder of this article provides a deeper dive, and in the Resources section we provide a comprehensive list of solutions available in the market today.

Full Autopilot?

First things first, are we really talking about fully automated HTS code classification and duty rate calculation? Because my first reaction would be: “No way are we putting something this critical and nuanced on autopilot”.

“No way are we putting something this critical and nuanced on autopilot.”

This is probably a good instinct, and if you watch our demo, you will see that while we could go full autopilot, our setup is aimed more at assisting a human. That said, there are some tasks, for example double checking shipping docs, that should go full autopilot. Others can likely get there as you build usage data (with a human in the loop for exceptions), especially if tariff rates aren’t changing daily.

How New Tech Is Adding Value

If we aren’t going full autopilot, what is the value proposition?

- Speeding up your work - tools are available to get you all the relevant data you need for your analysis, at your fingertips, removing much of the grunt work.

- Improving your accuracy - a key feature of the system in our demo is that it provides several potential HTS code options (and could provide more if we configure it that way), providing an outside perspective that might catch something you didn’t. The same goes for duty rate calculation.

Finally, all of this lays the groundwork to move towards full autopilot as mentioned above.

Now let’s quickly talk use cases.

Use cases

- Double checking your shipping docs - if you don’t have some form of this already, then implementing an automated system to double check shipping docs to me is a no-brainer.

- New products - this is the core use case, if your company frequently imports new items, then this is for you.

- New suppliers - if you’re exploring supplier options in different countries, then there is value here not only for checking country specific differences, but also exploring any nuances in the product, and of course double checking the shipping documents if you do move forward.

- Supply chain re-engineering - last but certainly not least, truly adapting to today’s paradigm may require re-imagining your supply chain, breaking your product down to its components, and re-considering where components are produced and assembled up to various levels. For this sort of scenario analysis, the ability to rapidly determine HTS codes and duties is key.

Solution Components

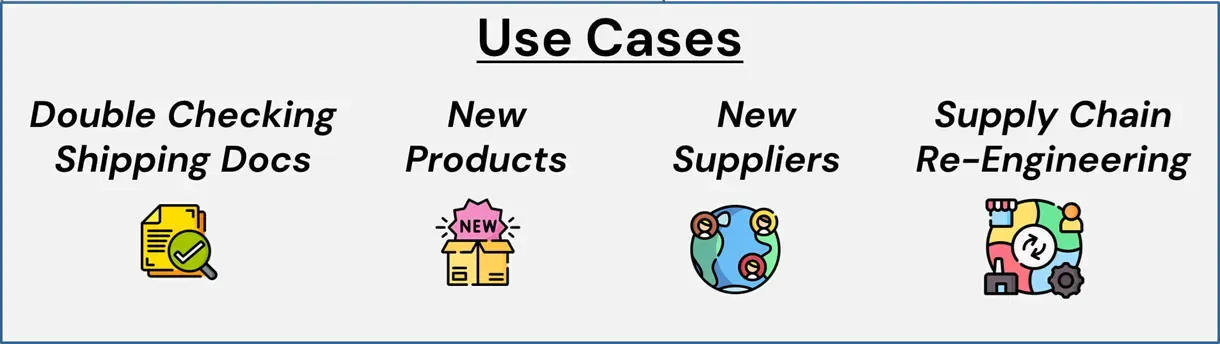

When it comes to landed cost analysis, there are three major steps, each with unique characteristics.

HTS Code Classification

HTS code classification is both a science and an art. It involves determining which of the more than 19,000 10-digit HTS codes your product should be classified under, and there is some room for interpretation, as evidenced in many of the CROSS rulings. This sort of language intensive, semi-unstructured problem is well suited for Large Language Models (LLMs).

Duty Calculation

This should be a much more deterministic, rules-based process. Input an HTS code, go through each applicable rule, output a duty rate. However, although it’s more deterministic, it's also complex, and I actually struggled to find tools that do it perfectly. See the deep dive below for more details.

Other Landed Cost Components

Finally, to get to a true landed cost you also need to consider your shipping cost, insurance costs, and other ancillary fees like your Merchandise Processing Fee or Harbour Maintenance Fee if you are shipping by ocean. This step should be relatively straightforward, although there is a sub-problem of forecasting shipping costs which can be challenging, especially for longer forecast horizons.

HTS Code Classification Deep Dive

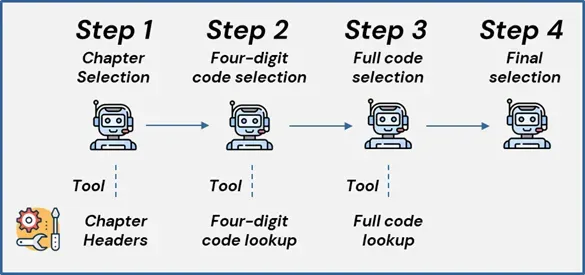

The classification agent we built determines codes over four steps, and is grounded in the actual HTS code definitions which it is forced to retrieve via the tools shown below. At each step it outputs a range of feasible options, gradually narrowing down the search space to get to the final result.

I was really impressed with its results on our small test dataset, which you can find here: test dataset.

To develop this agent further we would:

- Include info about the importer, what sort of company they are, what items they have imported in the past, HTS codes they have used in the past etc.

- Add a search tool to look up relevant CROSS rulings and potentially a general google search tool.

Duty Rate Calculation Deep Dive

We tried many different duty calculator tools, listed in the Resources section below. Ultimately, we selected Simply Duty for our demo based on its combo of pricing and quality. However, if you check the results from our test dataset closely, you will see that of the 9 duty rates calculated, 1 is actually incorrect.

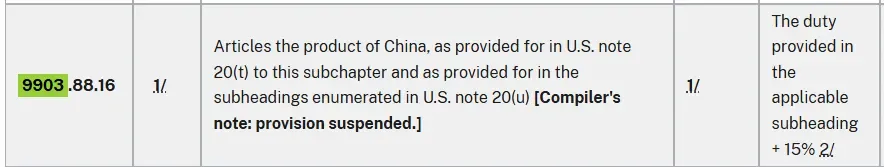

The issue is 6115.96.90.20. Its rate includes an additional 15% from 9903.88.16, but this provision has been suspended for a very long time.

I spoke with the team at Simply Duty, and they expressed that they tend to err on the side of caution, over-assessing rather than under-assessing, but given how long this provision has been suspended, it's concerning.

Now that said, I checked Simply Duty multiple times throughout April, and was impressed to see it rapidly & accurately update as the tariff situation shifted.

Overall, if you are looking for a low-volume, more budget friendly solution, I would recommend Simply Duty combined with a custom solution that double checks its output. However, if you are considering a bigger investment, Descartes Customs Info, TradeMo, or the UPS Global Checkout API are likely better choices.

Key Takeaways

New technology can make HTS code classification and duty calculation faster and more accurate, and there are a range of potential solutions available for different budgets and needs.

If you are urgently looking to perform this sort of analysis, our team can help, and we will leverage this technology to work faster and more accurately.

Beyond urgent needs, we can help to build automated workflows for the long term, considering use cases, volume, and your team’s preferred ways of working.

Resources

The following are resources that we have explored. During our exploration we moved quickly, and for most of these we only tested a small number of cases. The below represents our takeaways from this exercise, but may not be the full picture. If you are a representative of one of the companies below, feel free to reach out if you would like to add additional context.

Customs Info (Descartes)

Overview: Descartes is probably the leader in this space. Their solution powers the US Trade.gov Tariff Lookup Tool, a free service for US exporters to look up global tariff rates. It’s a great product, and they offer both a Web UI and an API.

Website: https://www.customsinfo.com/

HTS Classification: Yes

Duty Rate Calculation: Yes

Pricing: they offer a free trial that I recommend everyone try. Then at least have the conversation with their team about pricing.

TradeMo

Overview: TradeMo offers a very impressive suite of modules that rivals Descartes’ Customs Info. I watched a live demo of their classification product and their landed cost calculation product and was very impressed. They even identified the small Cotton Imports Assessment fee that applies to 6115.95.6000 but not to 6115.96.90.20.

Website: https://www.trademo.com/

HTS Classification: Yes

Duty Rate Calculation: Yes

Pricing: pricing is based on the number of user seats, volume of usage, and the number of modules, meaning you can purchase standalone access to just the classification module or just the landed cost calculation module.

UPS Developer Portal

Overview: UPS provides a Landed Cost API that seems to be totally free, but unfortunately it only gives the base duty rates (not including tariffs). Additionally, UPS has a Global Checkout API which is reported to provide the all in duty rates including tariffs, however, this is a paid service and I have not tested it yet.

Website: https://developer.ups.com/

HTS Classification: No

Duty Rate Calculation: Yes

Pricing: the Landed Cost API seems to be totally free, but the Global Checkout API requires a call with their sales team.

Quickcode AI

Overview: nice Web UI for HTS code classification, they also advertise duty rate calculation, but I was not able to try as it is behind a paywall. They do not mention API access, so my assumption is that this would have to be negotiated separately if they are open to it at all.

Website: https://quickcode.ai/

HTS Classification: Yes

Duty Rate Calculation: Yes (did not test)

Pricing: Entry pricing is $749 per month for unlimited use. Offers free trial with 10 free HTS code classifications per month forever.

Tariffy

Overview: simple and user-friendly API product. Send them a product description, and they send back the HTS code. Classifications seem to be pretty darn good.

Website: https://www.tariffy.com/

HTS Classification: Yes

Duty Rate Calculation: No

Pricing: entry level pricing is $19 per month for 500 API calls. Offers free trial.

Simply Duty

Overview: simple and user-friendly API. Send them an HTS code, origin, and destination, and they send you the duty rate. Works pretty well, but I did catch one mistake which is described in more detail in the Duty Rate Calculation Deep Dive above.

Website: https://www.simplyduty.com/

HTS Classification: Yes (does not work well)

Duty Rate Calculation: Yes

Pricing: entry level pricing is £ 9.99 for 100 api calls. Offers free trial.

Passage

Overview: a free chatbot style product where you can ask trade compliance questions. Useful for classification, but it does require a bit of back and forth for each product. I tried asking it about duty rates, and unfortunately the response was incorrect. It did clarify though that this use case is still under development.

Website: https://trypassage.com/

HTS Classification: Yes

Duty Rate Calculation: Maybe

Pricing: currently it is totally free!

Chatgpt (Custom GPTs)

Overview: ChatGPT has a number of custom gpts aimed at HTS code classification.

Website: https://chatgpt.com/g/g-blwArkJns-hts-us-code-finder

HTS Classification: Yes

Duty Rate Calculation: No

Pricing: Free

Dutify

Overview: I tried the Dutify landed cost API, but found that it missed the tariff under 9903.88.15. I only tested one HTS code, so it's possible the this is rare mistake for them, but given time constraints I didn’t expore further.

Website: https://dutify.com/

HTS Classification: Some functionality

Duty Rate Calculation: Yes

Pricing: Entry level pricing is $10 per month for 200 landed cost calculations. They offer 1 free landed cost calculation.

Easyship

Overview: I tried to use the Calculate Tax and Duty API from Easyship, but I found it only accepted 8 digit WTO HS codes with the last two digits as zero. This isn’t enough to get final all-in duty rates for import into the US, and indeed, when I ran the calculation for China to US with the first 6 digits plus two zeros, the rates it provided were totally off.

Website: https://www.easyship.com/

HTS Classification: No

Duty Rate Calculation: Maybe

Pricing: charges based on the number of shipments shipped through their platform, starting at free for up to 50 shipments per month, overall, the product is not directly targeted at our use case.